Understanding our Earth

We are a world-leading independent research organisation providing objective, expert geoscientific data, information and knowledge.

Latest news and events

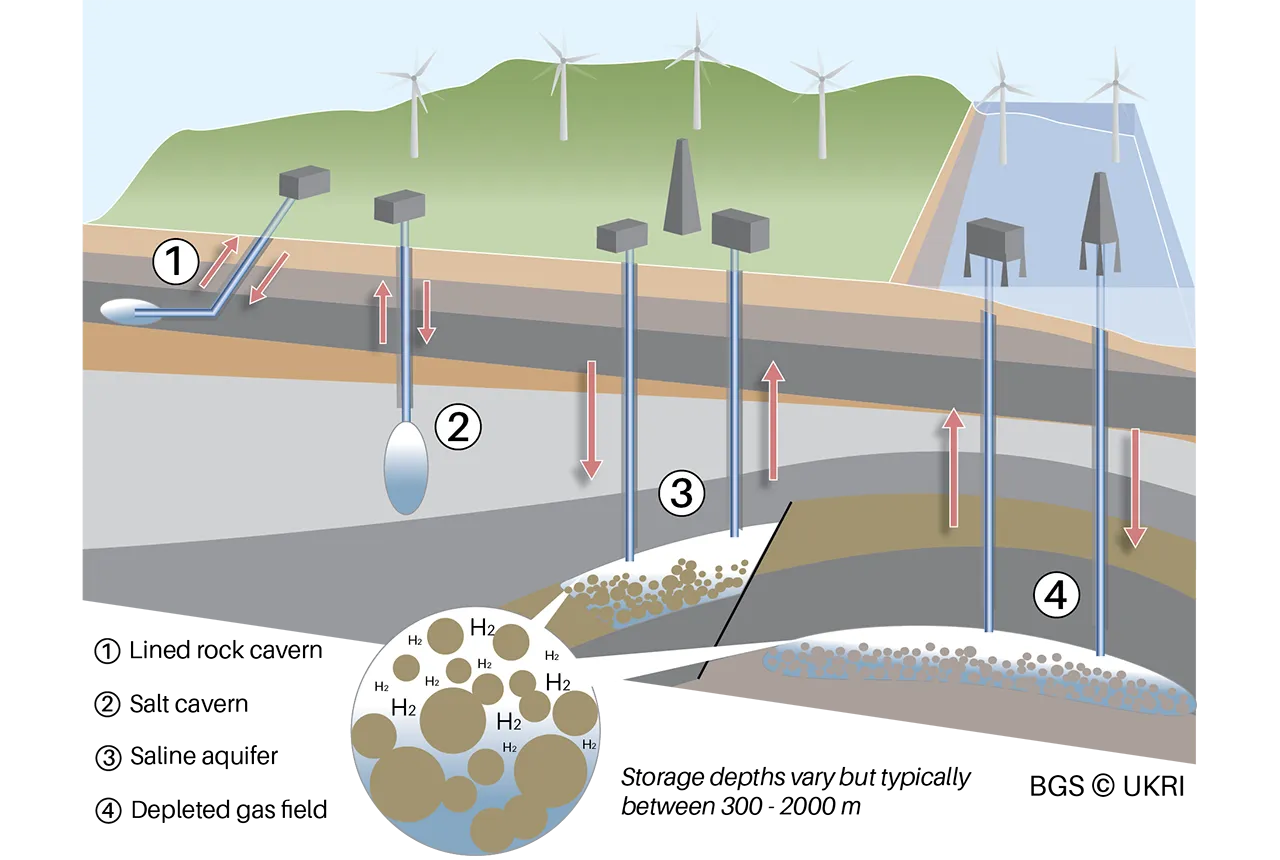

Making the case for underground hydrogen storage in the UK

03/04/2025

A new BGS science briefing note focuses on the potential of hydrogen storage to support the UK energy transition.

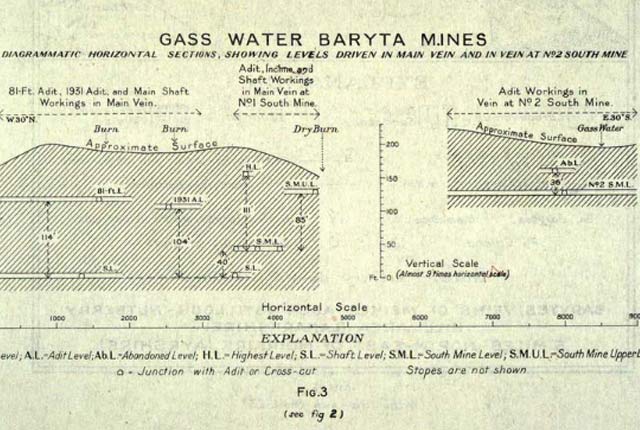

New data reveals latest mineral workings around Great Britain and Northern Ireland

01/04/2025

The newest release of BGS BritPits provides information on an additional 6500 surface and underground mineral workings.

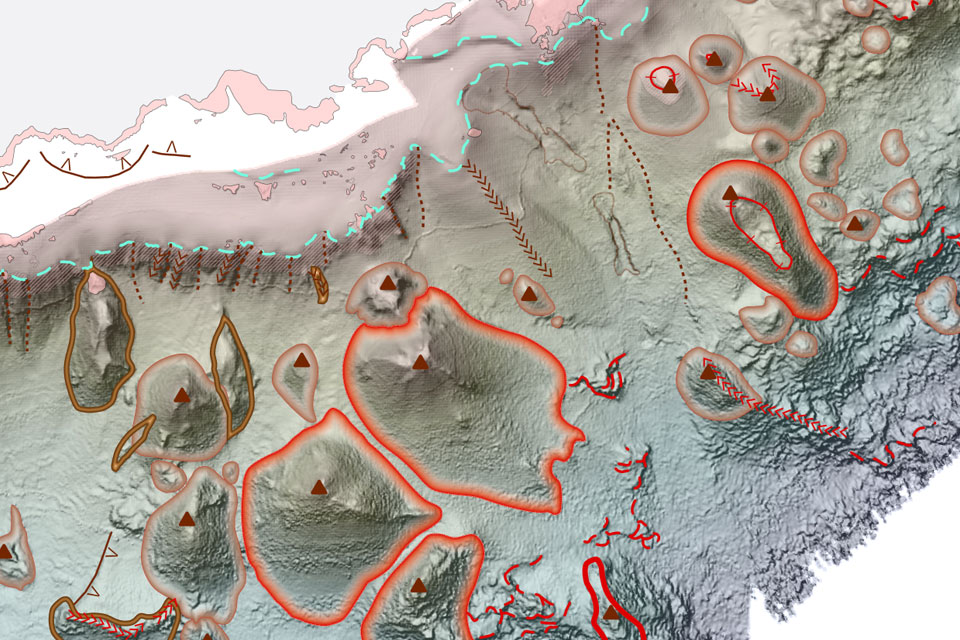

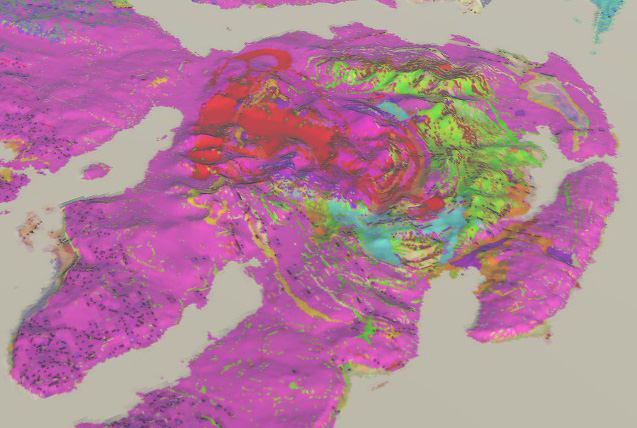

New seabed geology maps to enable long term conservation around Ascension Island

01/04/2025

BGS deliver the first marine geology and habitat maps for one of the World’s largest marine protected areas.

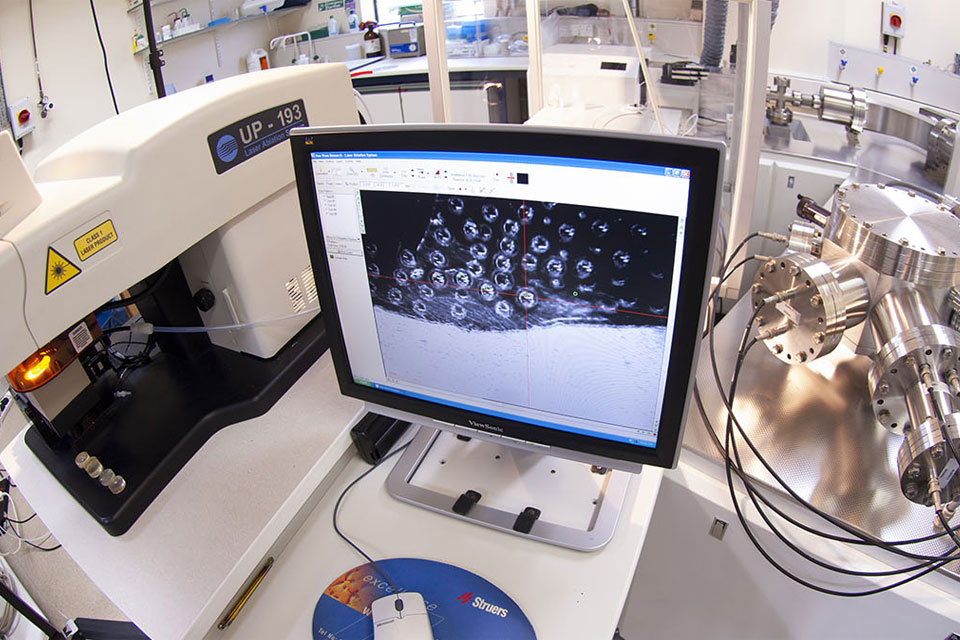

Exploring Scotland’s hidden energy potential with geology and geophysics: fieldwork in the Cairngorms

31/03/2025

BUFI student Innes Campbell discusses his research on Scotland’s radiothermal granites and how a fieldtrip with BGS helped further explore the subject.

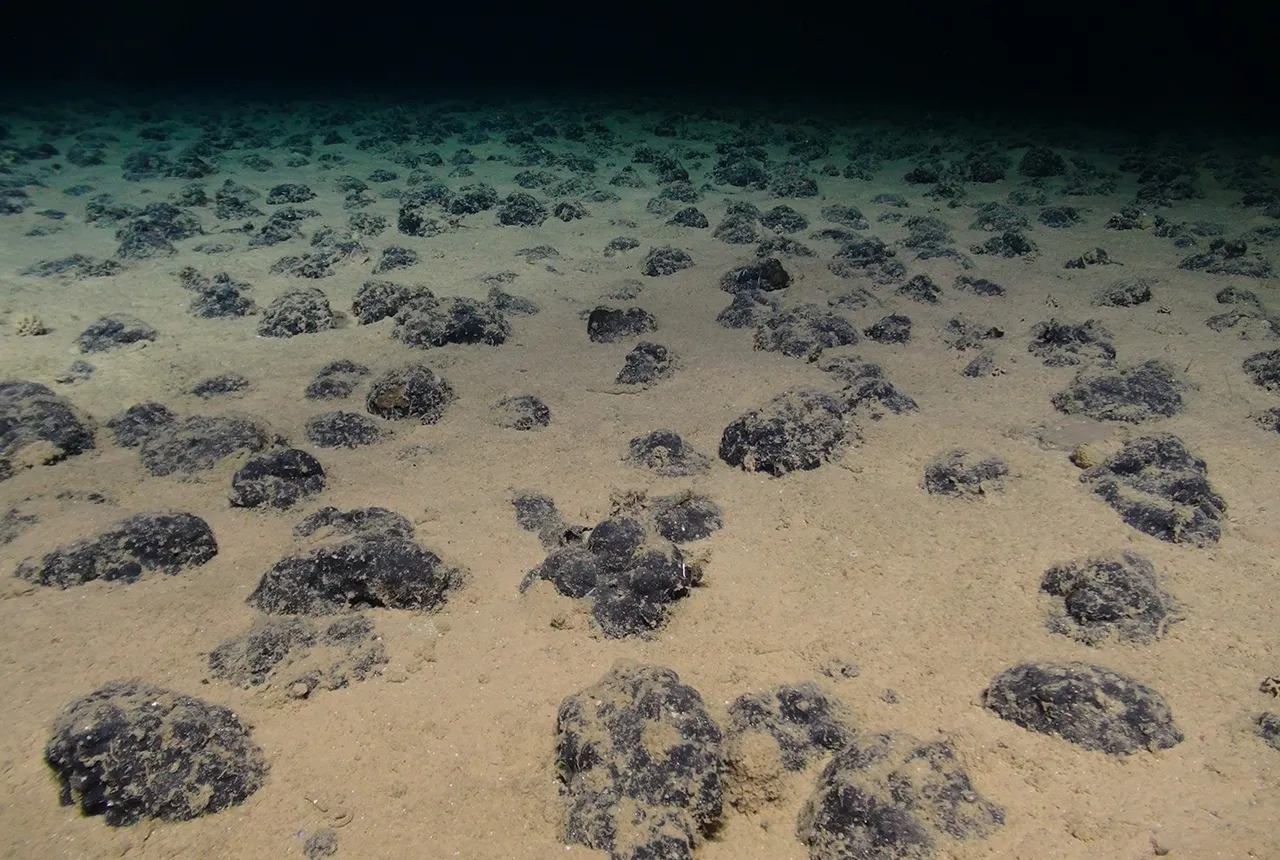

New study reveals long-term effects of deep-sea mining and first signs of biological recovery

27/03/2025

BGS geologists were involved in new study revealing the long-term effects of seabed mining tracks, 44 years after deep-sea trials in the Pacific Ocean.

BGS announces new director of its international geoscience programme

17/03/2025

Experienced international development research leader joins the organisation.

Future projections for mineral demand highlight vulnerabilities in UK supply chain

13/03/2025

New Government-commissioned studies reveal that the UK may require as much as 40 per cent of the global lithium supply to meet anticipated demand by 2030.

Presence of harmful chemicals found in water sources across southern Indian capital, study finds

10/03/2025

Research has revealed the urgent need for improved water quality in Bengaluru and other Indian cities.

Critical Mineral Intelligence Centre hosts second conference

28/02/2025

The Critical Minerals Intelligence Centre conference took place at BGS’s headquarters in Keyworth, Nottinghamshire.

Dr Kathryn Goodenough honoured with prestigious award from The Geological Society

27/02/2025

Dr Kathryn Goodenough has been awarded the Coke Medal, which recognises those who have made a significant contribution to science.

Call for new members and Chair to join the NERC facilities steering committees

18/02/2025

New members are needed to join the committees over the next four years.

BGS announces new director of BGS National Geoscience

12/02/2025

BGS announces its new director of BGS National Geoscience.

Our core challenge areas

Decarbonisation and resource management

Decarbonisation of power production, heat, transport and industry is a major challenge and one that intrinsically involves geoscience.

Multi-hazards and resilience

We work with partners worldwide to enhance understanding of hazards, vulnerability, exposure and risk to ensure our science is useful, usable and used.

International geoscience

BGS is active across the globe delivering institutional strengthening programmes and applied research projects across a wide variety of sectors.

National geoscience

The National Geoscience programme is a forward-looking investment in UK geology that provides relevant, coherent and enriched geoscience knowledge for our stakeholders.

Digital geoscience

The BGS is a data-rich organisation. Our data science and data infrastructure are fundamental to our future research and underpin our strategic challenges.

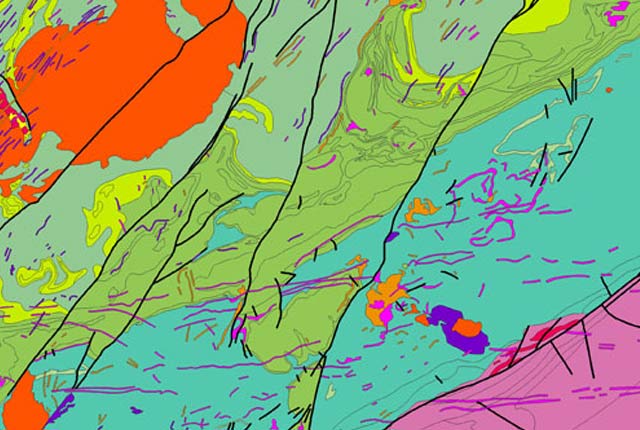

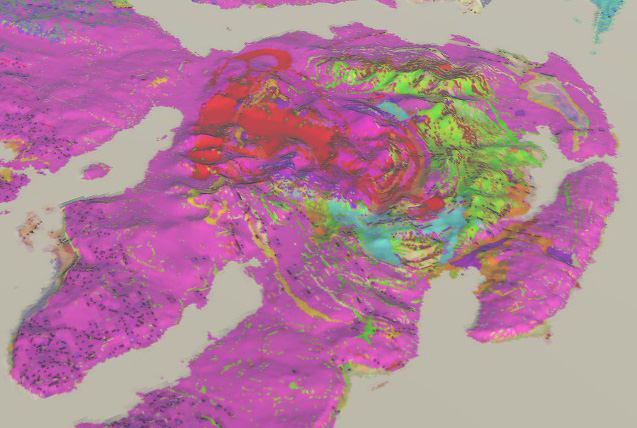

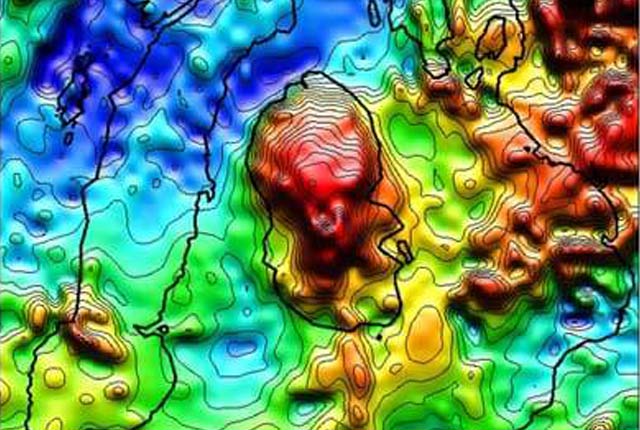

Map viewers

Data published through map viewers allowing you to reveal more about the ground beneath your feet.

Technologies

Applications, software and online services created by the BGS and our collaborators.

Information hub

Data collections, publications, scanned records and other data gathered by BGS and provided by external organisations.

OpenGeoscience

Accessing maps and downloading data, scans, photos and other information via BGS’s free OpenGeoscience service.

Digital geoscience

The BGS is a data-rich organisation. Our data science and data infrastructure are fundamental to our future research and underpin our strategic challenges.

Digital data licensing and resellers

Providing a wide range of licences for the use and utilisation of our information products by for those interested in an information product and the Open Government Licence is not applicable.

National Geoscience Data Centre

Collecting and preserving geoscientific data, making it available to a wide range of users and communities.

National Geological Repository

Hosting BGS’s collections of borehole cores, cuttings, samples, specimens, and related subsurface information from the UK landmass and continental shelf.

Discovering Geology

Discovering Geology introduces a range of geoscience topics to school-age students and learners of all ages. Explore these pages to discover the fascinating processes and properties that shape our dynamic planet.

Rocks and minerals

Find out more about the differences between rocks and minerals and how they are formed.

Discovering Geology: climate change

What is the difference between weather and climate? what causes the Earth’s climate to change and what are the impacts? Find out more with our Discovery Geology climate change resources.

Earth hazards

The Earth beneath our feet is constantly shifting and moving, and violently with catastrophic and immediate results. Find out more about earth hazards.

Geological processes

Planet Earth is dynamic with a surface that is always changing. Find out about the processes that cause these changes.

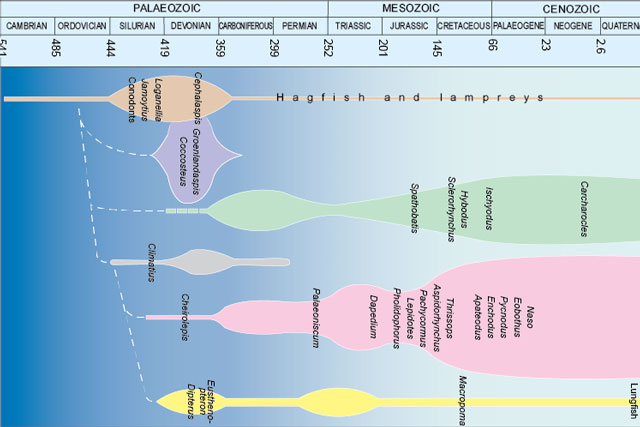

Fossils and geological time

Take a look at the history of the Earth, from its formation over four and a half billion years ago to present times.

About BGS

As the national geological survey, we are the UK’s premier provider of objective and authoritative scientific data, information and knowledge to help society understand our Earth.

Our data and services

The BGS offers a range of services and information for businesses, home-owners, policymakers and the general public.

Working with us

BGS is committed to being an employer of choice and strives to embrace a culture of inclusivity and flexibility.

Offices and locations

Find out more about our offices and facilities located across the UK.

Contact us

Find out more about the BGS and the services we offer through our enquiries and customer services team.